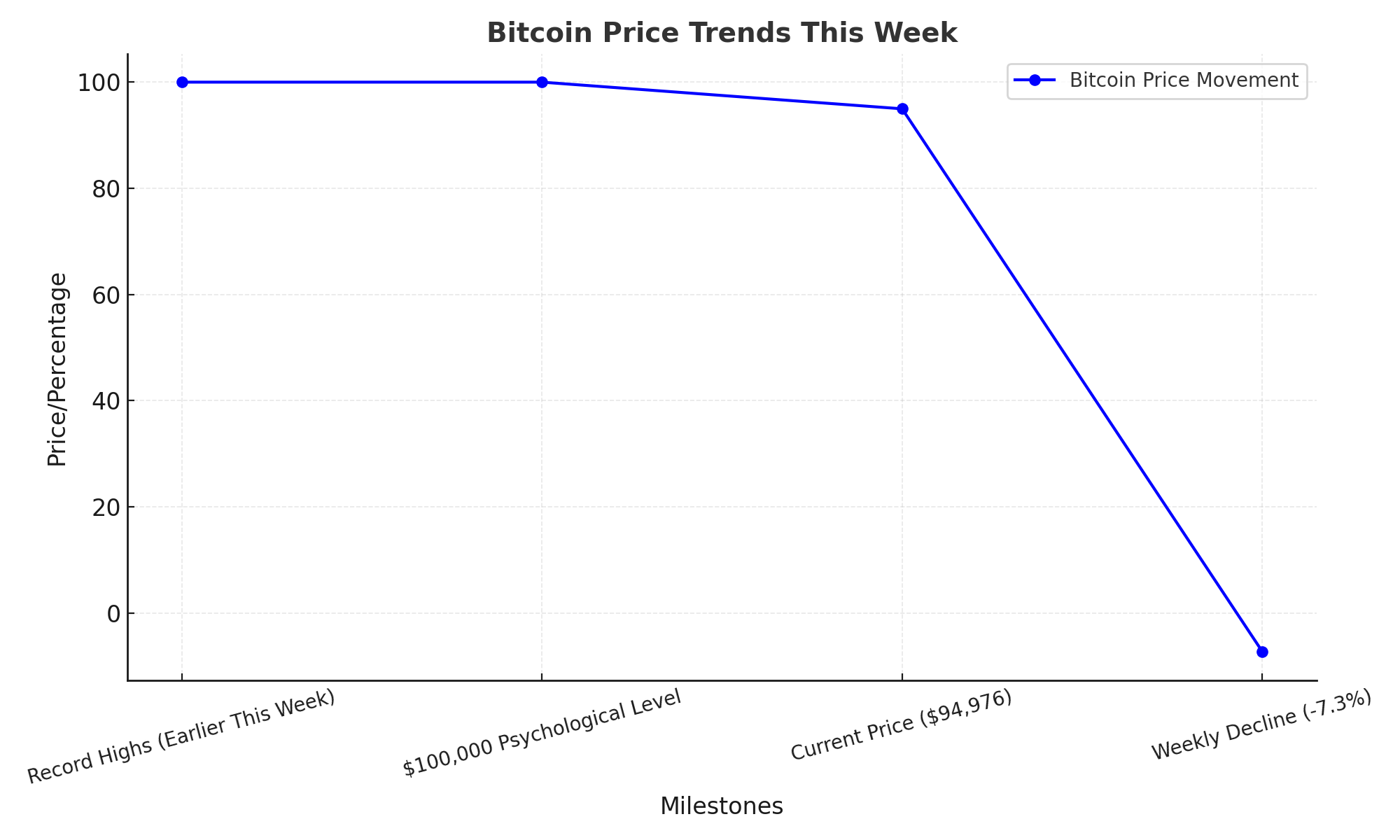

Bitcoin, the leading cryptocurrency, has faced significant volatility this week, leaving investors on edge. After reaching record highs earlier in the week, Bitcoin’s price plummeted, testing the critical $100,000 psychological level. With its price now at $94,976, according to CoinDesk, this decline has raised questions about the factors influencing the digital asset’s sudden downturn.

This article delves into the reasons behind Bitcoin’s rough week, its connection to broader financial markets, and what the future might hold for the world’s most popular cryptocurrency.

Why Is Bitcoin Facing a Tough Week?

Bitcoin’s recent slump is tied to a combination of macroeconomic factors and cyclical trends within the crypto market.

1. Federal Reserve Comments on Interest Rates

On Wednesday, the Federal Reserve dampened investor sentiment by signaling fewer interest rate cuts in 2025. These comments sent ripples across equity markets, which in turn affected cryptocurrencies. The relationship between traditional markets and crypto assets, particularly Bitcoin, has grown stronger over time, making such economic updates critical to its performance.

2. Inflation Data Looms Large

The Personal Consumption Expenditures (PCE) index for November, scheduled for release on Friday, plays a significant role in shaping the Federal Reserve’s monetary policy. Any signs of persistent inflation could further delay rate cuts, impacting both the stock and crypto markets.

The Broader Impact on the Crypto Sector

Bitcoin isn’t alone in this downturn; the entire cryptocurrency market has felt the pressure.

Stock Market Pullback

The S&P 500 experienced its worst Fed decision day in nearly 15 years, dropping 2.95%. Such a significant pullback in the stock market often creates ripple effects in the crypto market, which has become increasingly correlated with equities.

Strength Amid Weakness

Despite the 7.3% drop in Bitcoin’s value over the past 24 hours, analysts like FxPro’s Alex Kuptsikevich see this as a display of resilience. Bitcoin’s decline mirrored the stock market’s movement, showing relative strength compared to its historically more volatile nature.

Bitcoin’s Cyclical Nature

Bitcoin operates in cycles, often influenced by market psychology and external factors.

The $100,000 Psychological Barrier

Crossing key psychological levels, like $100,000, often brings a mix of hype and caution. This week, Bitcoin’s attempt to maintain its upward momentum met resistance at this milestone, resulting in a pullback.

A Year of Growth

Despite this week’s turbulence, 2023 has been a strong year for Bitcoin, with gains of 130%. Much of this growth has been fueled by expectations of regulatory easing under the new U.S. administration.

What’s Next for Bitcoin?

While this week’s events may seem unsettling, they also set the stage for potential growth in 2024.

Cyclicality and Future Trends

As Kuptsikevich noted, Bitcoin’s cyclicality suggests that periods of consolidation often precede significant upward momentum. The current pullback could serve as a foundation for further price growth in the coming year.

Investor Sentiment and Regulation

With regulatory developments on the horizon, Bitcoin’s trajectory will depend on how governments and financial institutions approach the cryptocurrency industry. Optimism surrounding regulatory clarity could act as a catalyst for future price increases.

Table: Bitcoin Price Movement and Influencing Factors

| Aspect | Details |

|---|---|

| Current Price | $94,976 (as of the latest update) |

| Recent High | Record highs earlier this week |

| Weekly Decline | 7.3% |

| Key Psychological Level | $100,000 |

| Macroeconomic Factor | Federal Reserve signals fewer interest rate cuts in 2025 |

| Inflation Data Impact | November PCE report critical for future monetary policy |

| Stock Market Correlation | S&P 500 fell 2.95%, influencing Bitcoin |

| Year-to-Date Growth | Bitcoin up 130% in 2023 |

Final Thoughts

Bitcoin’s recent price plummet is a stark reminder of the volatility inherent in the crypto market. However, this isn’t the first time the digital asset has faced such turbulence, and history suggests it could recover and even thrive in the long term.

Investors should keep a close eye on macroeconomic indicators, regulatory updates, and Bitcoin’s ability to break through psychological barriers like $100,000. While the road ahead may be uncertain, Bitcoin’s resilience and cyclical trends offer hope for its continued growth.