India continues to lead the world in digital payments innovation, and now it’s taken another major leap. The country has launched its first-ever UPI-enabled ATM, a revolutionary step in how citizens withdraw cash—without a debit card, OTP, or even touching the ATM screen.

This new facility, powered by the Unified Payments Interface (UPI), is designed to bring convenience, security, and accessibility to the next level. But how does this differ from existing cardless cash withdrawals, and why is this seen as a game-changer?

Let’s explore the details.

🏦 What is a UPI ATM?

A UPI ATM is an automated teller machine that allows users to withdraw cash directly using UPI apps like PhonePe, Google Pay, Paytm, BHIM, etc., instead of traditional debit cards.

Developed by Hitachi Payment Services in collaboration with the National Payments Corporation of India (NPCI), this ATM operates under the Interoperable Cardless Cash Withdrawal (ICCW) framework.

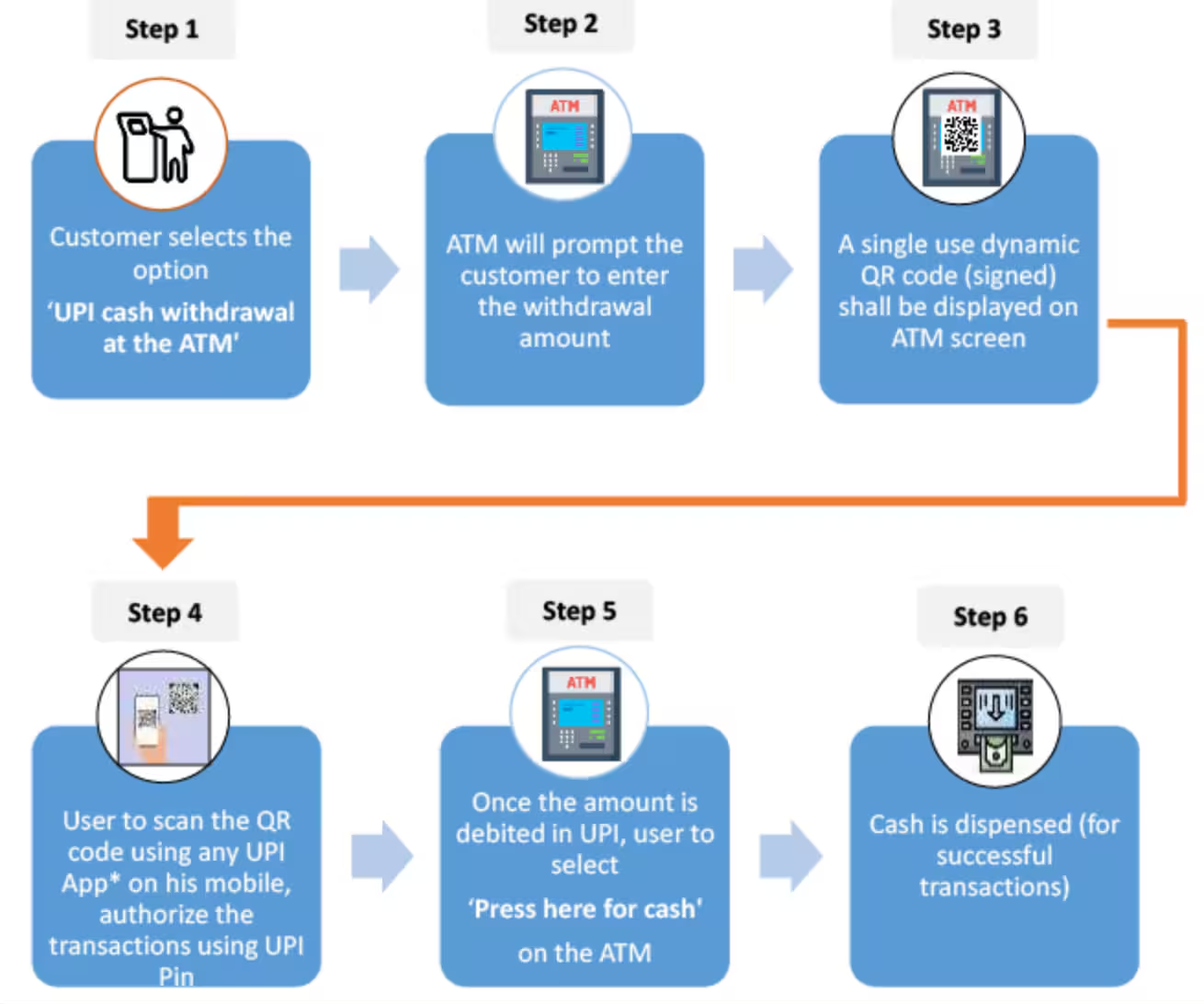

🔄 How It Works: Step-by-Step

Using a UPI ATM is simple and quick:

-

Go to the ATM and select the option “UPI Cash Withdrawal.”

-

A QR code will be displayed on the ATM screen.

-

Open any UPI app on your mobile phone.

-

Scan the QR code displayed on the ATM.

-

Enter the amount you want to withdraw.

-

Authorize the transaction using your UPI PIN.

-

The ATM dispenses cash instantly.

🔍 How Is It Different from Cardless Withdrawals?

| Feature | UPI ATM | Traditional Cardless Withdrawal |

|---|---|---|

| Authentication | UPI app + UPI PIN | Bank app + OTP/SMS |

| Security | QR-based, no sharing of sensitive data | Often uses mobile number, more vulnerable |

| Interoperability | Works with any UPI app | Limited to specific banks and apps |

| Hardware Dependency | No card reader needed | Requires biometric or SMS verification |

| User Experience | Seamless and fast | Multiple steps and limited banks |

💡 Why UPI ATMs Are a Game-Changer

✅ No Debit Card Needed

Forget plastic cards or remembering PINs. All you need is your mobile and UPI app.

✅ More Secure

No risk of card skimming, cloning, or PIN theft. QR code-based authentication makes it extremely secure.

✅ Bank-Agnostic Functionality

Works across all UPI-enabled banks and doesn’t require customers to be at their home bank’s ATM.

✅ Rural Empowerment

Helps people in semi-urban and rural areas where physical banking infrastructure is limited but smartphones are widely used.

✅ Real-Time Convenience

Instant transactions, 24/7 access, and reduced ATM hardware dependency make it ideal for the digital age.

🚀 Where Are UPI ATMs Available?

The rollout of UPI ATMs began in pilot phases across select cities in India such as Mumbai, Delhi, Bengaluru, and Hyderabad. Over the next 12–18 months, banks and ATM providers are expected to install these machines in both urban and rural areas.

🏦 Which Banks and Apps Support UPI ATM?

The facility is expected to be interoperable across all major UPI apps and banks. That means you can use:

-

UPI Apps: PhonePe, Google Pay, Paytm, BHIM, Cred, etc.

-

Banks: SBI, HDFC, ICICI, Axis, Kotak, Union Bank, and many more.

Note: Support may vary during the initial phase, so users should check for compatibility.

📌 FAQs (Frequently Asked Questions)

1. What is the maximum withdrawal limit for UPI ATMs?

Currently, it follows the same withdrawal limit as your bank’s UPI or ATM limit, generally around ₹10,000–₹20,000 per day.

2. Do I need internet access to use UPI ATM?

Yes, your mobile phone needs to be connected to the internet for the UPI app to function.

3. Are UPI ATMs safe?

Yes. They are safer than traditional methods since they eliminate card usage and rely on secure UPI PIN-based authorization.

4. Can I use any UPI app with UPI ATMs?

Most major UPI apps are compatible. The ATM will show if your app is supported during the scan phase.

5. Will I be charged extra for using a UPI ATM?

As of now, NPCI has not announced any additional charges for UPI ATM usage. Standard ATM usage charges may still apply after the free limit.

🔚 Final Thoughts

The launch of India’s first UPI ATM marks a milestone in digital banking. It combines the security of UPI with the convenience of cash withdrawal—without plastic cards, OTPs, or hassles. As the world watches, India continues to push the boundaries of fintech innovation. This is not just an upgrade; it’s a reimagining of how banking meets mobility and trust.

Stay tuned, because the future of ATMs is contactless, cardless, and powered by UPI.