Shares of Vedanta Ltd. experienced a significant rise of over 7% on Friday, reaching a high of ₹505.45 on the Bombay Stock Exchange (BSE). This surge followed the company’s announcement regarding the release of encumbrances on its equity shares by its parent company, Vedanta Resources Ltd. (VRL), and its subsidiaries.

Key Developments Behind the Surge

Encumbrance Release

| Details | Highlights |

|---|---|

| Announcement | Vedanta Resources Finance II PLC redeemed $1.2 billion worth of bonds, originally due in 2025 but extended to 2028. |

| Impact | Resulted in the release of encumbrances on Vedanta’s equity shares, previously tied to these bonds. |

| Clarification | A Vedanta spokesperson confirmed no promoter group entities pledged equity shares in relation to the bonds. |

Conditions of Bond Terms

| Requirement | Details |

|---|---|

| No Encumbrance Clause | Promoter group entities were prohibited from creating encumbrances on assets directly held unless specific conditions were met. |

| Control Clause | VRL and its subsidiaries were required to maintain control of over 50% of Vedanta’s equity shares during the bond’s tenure. |

Long-Term Growth Catalysts

Vedanta’s performance is also buoyed by strategic initiatives such as the demerger plan, announced on September 29, 2023.

Demerger Details

| Aspect | Details |

|---|---|

| Objective | To create six independent “pure play” entities. |

| Expected Benefits | Unlock value, attract sector-specific investments, and enhance strengths. |

| Market Cap Projections | Post-demerger, market capitalisation is expected to grow from ₹1.8 lakh crore to ₹3 lakh crore by March 2025. |

Analyst Outlook

Equirus Wealth, which has a target price of ₹560 for Vedanta, believes the demerger could significantly boost the company’s long-term growth potential.

Stock Performance Overview

| Date | Stock Price | Change |

|---|---|---|

| December 4, 2024 | ₹505.45 (High) | +7% |

| December 4, 2024 | ₹501.35 (Mid-Day) | +6.17% |

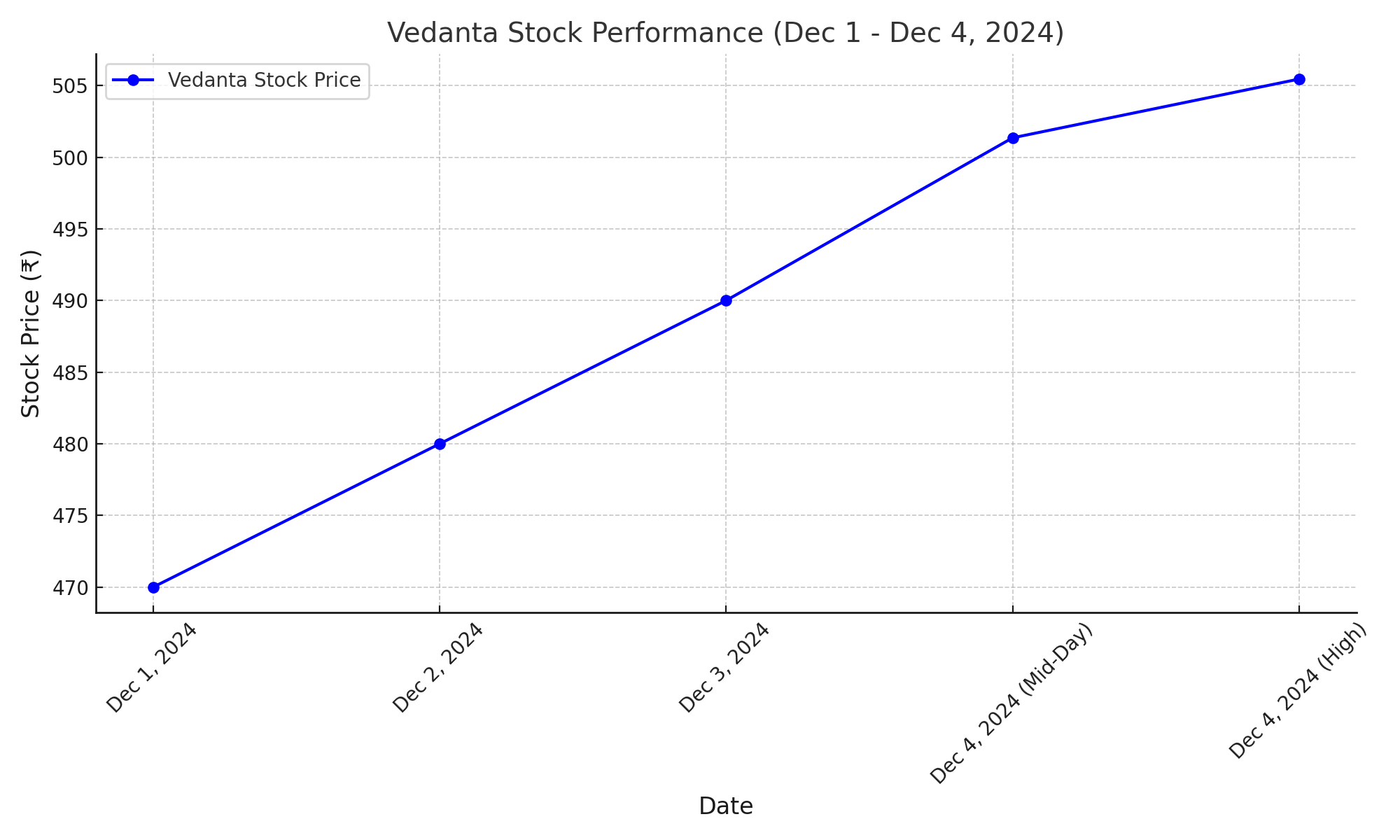

Chart: Vedanta’s Stock Surge

Below is a chart illustrating Vedanta’s recent stock performance, highlighting the impact of the encumbrance release and bond redemption.

Vedanta’s recent rally underscores the positive impact of strategic financial decisions and its focus on long-term growth. The release of encumbrances and the upcoming demerger plan position the company for sustained market strength. Analysts’ bullish outlook further reinforces Vedanta’s growth potential, making it a compelling stock to watch.